Keizer Fire Levy

In the November 2023 election, Keizer Fire District will ask voters for a five-year local option levy to continue providing essential funding for fire and emergency medical services.

Keizer Fire District has a permanent tax rate of $1.35 per $1,000 of assessed value. Currently, Keizer Fire District relies heavily on a Local Option Levy at the rate of $0.59 per $1,000 to fund emergency operations in addition to the permanent tax rate. This levy rate was set in 2012 and has remained unchanged since. This levy rate is no longer sufficient to maintain operations. A Levy rate of $0.99 per $1,000 of assessed value will ensure that we can do the following:

- Sustain current levels of service.

- Maintain our response time standard of 6 minutes or less.

- Retain all current positions.

- Add 4 additional Firefighter/Paramedics to address increasing call volume.

- Fill a vacant Community Risk Reduction Specialist Position to focus on school and community risk reduction efforts

- Keep pace with the growth of the city and prepare for the needs of our citizens now and into the future.

Keizer Fire District uses comparable fire agencies in the State of Oregon as a basis for wages, benefits and contract negotiation. Of these 8 comparable agencies, Keizer Fire has the lowest permanent tax rate, with the next lowest being Hermiston Fire at $1.75, and the highest being Douglas County Fire District #2 at $3.16.

Fire Levy Information

The proposed levy rate is the lowest amount Keizer Fire District could ask for to maintain current operations and sustain Keizer Fire until 2028. There are several contributing factors as to how we chose the proposed levy rate of $0.99 cents per $1,000 of assessed value.

- The levy rate has not been increased since 2013. Keizer Fire District has been working with the same funding rate set a decade ago.

- Growing needs have outpaced the existing funding.

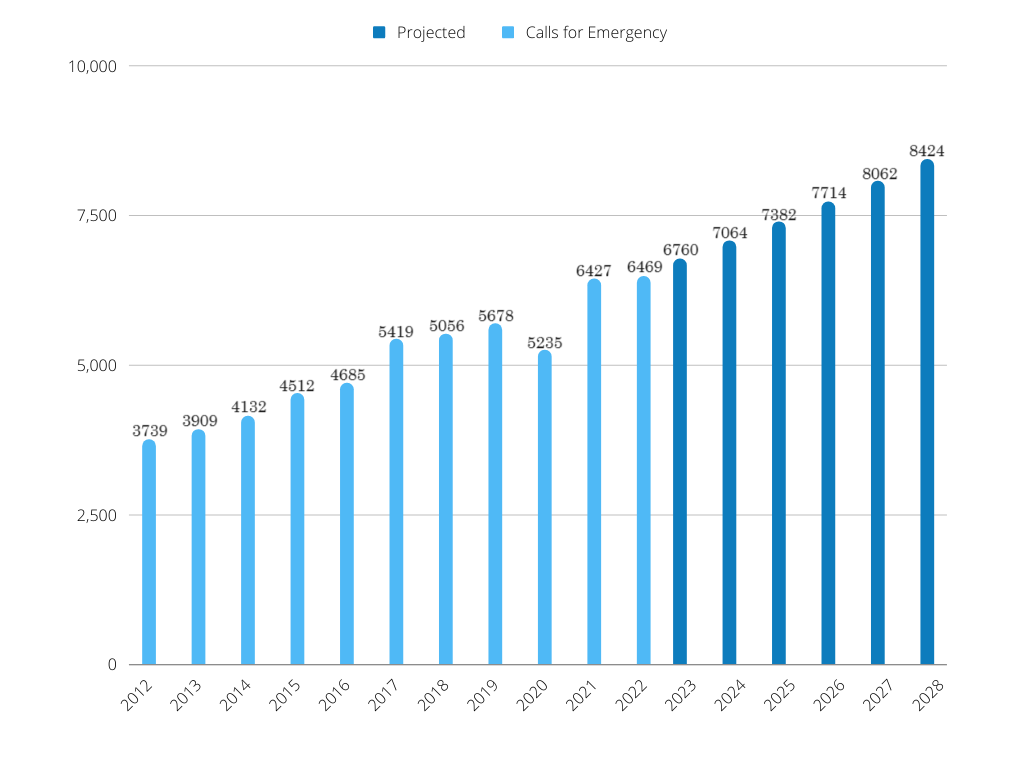

- Our call volume has increased by 73% since 2012. This means more demand for service and more resources are needed to respond to the growing call volume.

- Inflation has had a significant impact on costs to the District.

- New development does not result in an equal increase to tax revenue, resulting in a need to seek additional operating funds from the voters in the form of levies to provide services.

- Between now and 2028, the call volume is anticipated to increase approximately 30%.

The new amount requested from voters will be $0.99 cents per $1,000 assessed value (a $0.40 cent increase). Our estimates show this will cost the average Keizer property owner around $7.50 a month more than the current levy. For a total of $19 a month, Keizer Fire will be prepared to continue to serve the community with professionalism and care. The levy increase allows Keizer Fire District to retain the firefighter/paramedics and services from existing levy funding, and to expand services to keep up with the needs of our growing community now and into the future.

For a flyer to share click here: 2023 Levy Flyer

Increased Call Volume

In 2013, Keizer voters approved a local levy at the rate of $0.59 per $1,000 of assessed property value. Voters approved a renewal of this levy in 2018. In the 10 years since the last levy rate adjustment, emergency calls have increased 73%.

The graph below shows our annual emergency call volume. To address the increase in calls, Keizer Fire District has added 5 additional personnel over the 5-year length of the levy. Adding additional personnel has allowed us to maintain our response time goal of arriving at your emergency in 6 minutes or less 90% of the time.

Increased Costs

In the 5 years since the last levy renewal, we have endured a pandemic, record inflation, and rising costs of fuel, medical supplies, and supply chain shortages.

The current levy rate has not changed since 2013. Keizer Fire District has been attempting to keep up with a 73% increase in call volume and ever-increasing expenses with a levy amount from a decade ago. Due to state tax regulations, Keizer Fire District’s permanent tax rate cannot be increased to provide for the increased demand for services.

Keizer Fire District has experienced a 44% increase in cost of medical supplies over the last 5 years. These supplies are essential equipment used by paramedics on emergency calls.

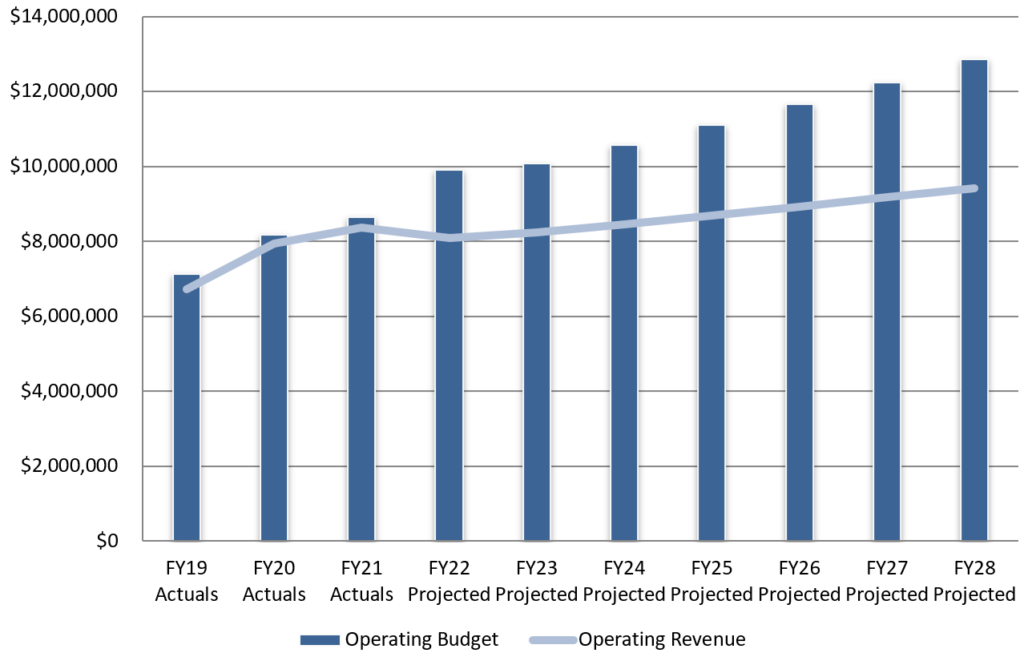

Costs are outpacing the increases in funding.

- Annual operating cost increase – 5%

- Annual operating revenues increase – 2.75%

- Revenue is primarily property tax which is constrained by TAV

New Construction

Oregon State Measures 5 and 50 are really the key as to why local governments in Oregon aren’t receiving enough operating funding from property taxes, and why organizations like Keizer Fire District have to ask voters to approve bonds and levies.

If you live in Keizer, it’s obvious that the community is experiencing growth. New homes and apartment complexes are being built throughout our community. These homes and apartments (or any homes built after Measures 5 and 50 were put in place in the 90s) do contribute to the overall tax base, but due to these measures, housing is assessed at a rate much lower than market value, and the assessed value is what property taxes are based on. This is because when Measures 5 and 50 were put in place, tax assessed value of properties were capped to only grow 3% each year.

So, what does this have to do with new construction? The rate for new housing is based on the assessed value of comparable houses in the area. This means that increasing market value, even of new construction, does not result in an equal increase to tax revenue, resulting in a need to seek additional operating funds from the voters in the form of levies to provide services.

Why Response Times Matter

Response times refer to the amount of time that it takes for an Emergency Service to arrive at the incident location. These times are critical in emergency situations to ensure that assistance and intervention reach those in need quickly. Keizer Fire District’s current response time is 6 minutes or less, for 90% of the calls that we receive.

The key components of response times for a fire department are:

- Dispatch Time: The time taken from receiving the emergency call to alerting and dispatching the appropriate emergency response units (e.g., fire trucks, ambulances).

- Turnout Time: The time it takes for the emergency response units to prepare, get into their vehicles, and start moving toward the incident location after being dispatched.

- Travel Time: The duration it takes for the emergency response units to reach the location of the incident from their starting point (e.g., fire station). This includes navigating through traffic, road conditions, and distance.

- Total Response Time: The sum of dispatch time, turnout time, and travel time. This represents the overall time taken from receiving the emergency call to reaching the incident location.

Keizer Fire District tracks response times for every emergency call. Response times represent how long it takes emergency crews to arrive on scene from the time a person calls 911. Keizer Fire District has a response time standard of arrival to your emergency in 6 minutes or less, 90% of the time.

Faster response times directly correlate with better patient outcomes and more lives and property saved for both fire and emergency medical calls.

In emergencies involving fire, faster response times means keeping fires as small as possible, which equates to more property saved. Fires can double in size every 30 seconds and quickly become un-survivable in a matter of minutes.

For medical calls, faster response times result in better patient outcomes. Fast response times mean responders are on scene quickly, providing lifesaving treatment and quickly transporting the patient to the hospital for continued care. Cardiac arrest survivability decreases 10% each minute, the sooner care is initiated, the greater the chance of a positive outcome for the patient.

Coverage Area

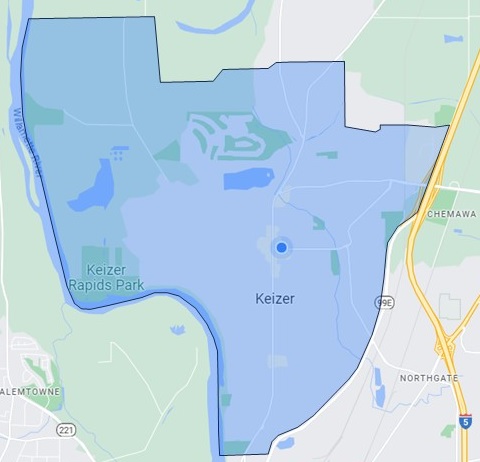

This reflects Keizer Fire District’s coverage area.

In this area are the following:

- 39,561 citizens.

- 10 Assisted Living Facilities.

- 147 Apartment Complexes with 5 more being built.

- More than 700 businesses.

- 14,024 Single Family Homes with around 3 family members each.

- 19 Parks

- 9 Schools

FAQ’s

What is a Levy?

A Levy is a funding option that must be approved by voters. It is a type of tax used to fund specific projects, programs, or services. The tax rate is determined based on assessed property values within the Fire District’s taxing authority. Levies can last for up to five years before expiration and then voters must approve a renewal or a new levy.

What is the cost to the average Keizer home owner?

The average cost for homeowners in Keizer will be about $7.50 per month more than the current levy. At the new levy rate, the average cost to a homeowner will be about $19 per month. This amount is based on a property with a taxable assessed value of $230,000.

The taxable assessed value is the amount that the local tax authority has estimated a property owner’s structures and land to be. In Oregon, this amount is typically much lower than market value due to a cap on property tax that was put in place by State Measures 5 and 50. Home owners in Keizer can check their taxable assessed value on the Marion County Tax Assessor’s website, Marion County Tax Assessor.

Why is Keizer Fire District asking for this levy?

The current levy rate was established in 2012 and is no longer sufficient. It no longer accounts for the increase in call volume, increase in operating costs, or the increase in population within Keizer.

What will be accomplished with the revenue from a passed levy?

Keizer Fire District will be able to account for the increasing call volume, the increasing costs of essential supplies and continue to respond to your emergency in 6 minutes or less.

What happens if the levy does not pass?

If the proposed levy is not passed by voters in November, Keizer Fire District will have an opportunity to propose a levy on the May 2024 ballot before the existing levy expires in June 2024. If a new levy is not passed by this time, Keizer Fire District will have to reduce the level of service currently provided to the community. Reductions could be in the form of layoffs, decreasing the number of resources responding to emergency calls.